|

TSOP NO: |

3.06 |

|

SUBJECT: |

Employer Provided Education Tax Implications |

|

SOURCE: |

University Tax Services, University Human Resources, University Bursar |

|

ORIGINAL DATE OF ISSUE: |

3/27/17 |

|

DATE OF LAST REVISION: |

5/10/2017 |

|

RATIONALE: |

The purpose of this Tax Standard Operating Procedure is to provide units guidance on when certain payments, (cash or non-cash) made by IU, for educational purposes for an employee, could be considered taxable income to the employee. This pertains only to education benefits outside IU Tuition Benefit . Per the IRS, under the Internal Revenue Code Section 132 ( IRC §132 ), certain educational benefits provided to employees are considered taxable and should be reported as non-cash fringe benefits to be included on the employee’s Form W-2. If an IU employee receives educational benefits, as part of a valid IU business expense, under the IRS Accountable Plan rules – see IU Policy FIN-ACC-I-620 Reimbursement Under the Accountable Plan , then no tax implications exist to the employee. Any educational benefit provided outside of the Accountable Plan Rules and IU Tuition Benefit will likely be taxable to the employee. Other scenarios should be described via email and sent to taxpayer@iu.edu for review and discussion. |

|

PROCEDURES: |

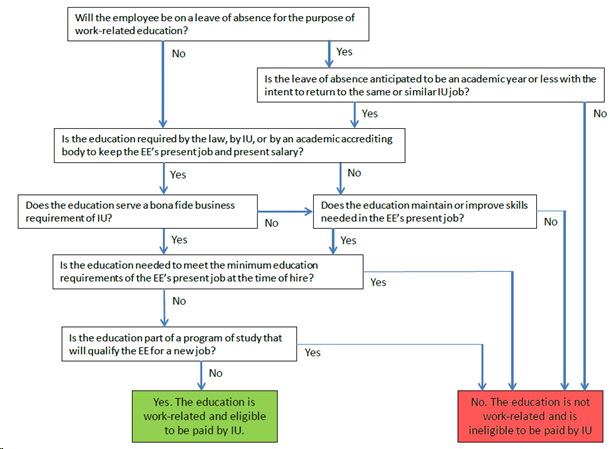

Step 1:Units should also review IU Policy HR-04-30: Employee Benefit Plans to ensure no breach in policy will occur in funding educational expenses for an employee. Step 2:Review flowchart below for job-related purpose. This review should be done before contacting your Campus Budget/Finance Administrator to facilitate a discussion for business purpose. Step 3:Contact the Campus Budget/Finance Administrator for your campus for approval. If the Campus Budget/Finance Administrator grants approval, contact taxpayer@iu.edu for determination of tax implications (if any) to the employee. FLOWCHART FOR JOB-RELATED DETERMINATION:

|

|

EXAMPLES: |

SCENARIO 1: IU Classes Taken by IU EmployeeThis scenario pertains to an IU unit covering the additional cost of tuition after IU Tuition Benefit has already been applied or if the employee chooses to forgo utilizing the IU Tuition Benefit and the unit is covering the entire cost of tuition and fees though SIS. See Examples below. Under this scenario, a determination should be made first to determine if the courses taken are considered job-related, and therefore, not taxable to the employee. If the courses are considered a business expense and IU has a true current business need for the employee to have the additional education, there are no taxable implications to the employee. EXAMPLES:

SCENARIO 2: Non-IU Classes Taken by IU EmployeeThis scenario pertains to a unit covering the full or partial cost of education at another institution or professional agency (CPA, etc.). These payments are normally paid through Accounts Payable as a direct payment to the institution or agency, or directly to the individual as an Out of Pocket Expense Reimbursement. Under this scenario, a determination should be made first to determine if the courses taken are considered job-related, and therefore, not taxable to the employee. If the courses are considered a business expense and IU has a true business need for the employee to have the additional education, there are no taxable implications to the employee. NOTE: As a business expense, it is expected that the unit, not the employee, would be the initiating party for the additional education. For compensation, it is expected that the employee asked the unit to cover the costs. This is not always the case, but helps with the tax determination. EXAMPLES:

|

|

DEFINITIONS: |

Employee Benefits (per HR-04-30): includes all forms of direct or indirect reimbursements, subsidies, payments, etc. for non-business activities, as defined by IRS regulations. |

|

CROSS REFERENCES: |