|

TSOP NO: |

8.01 |

|

SUBJECT: |

Remitting and Recording Sales Tax in KFS for the State of IN and others |

|

SOURCE: |

University Tax Services - Financial Management Services |

|

ORIGINAL DATE OF ISSUE: |

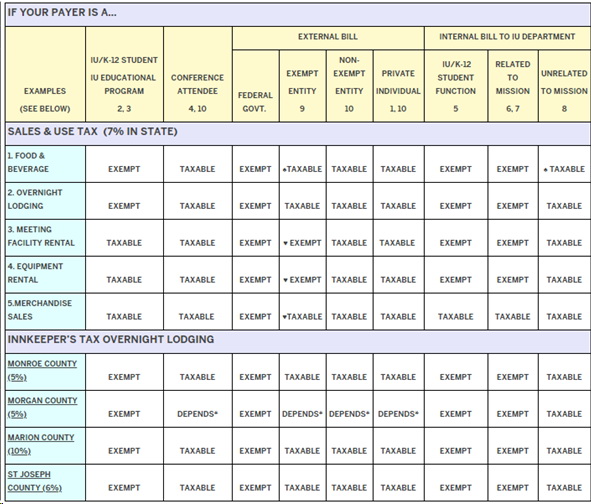

03/10/2016 |

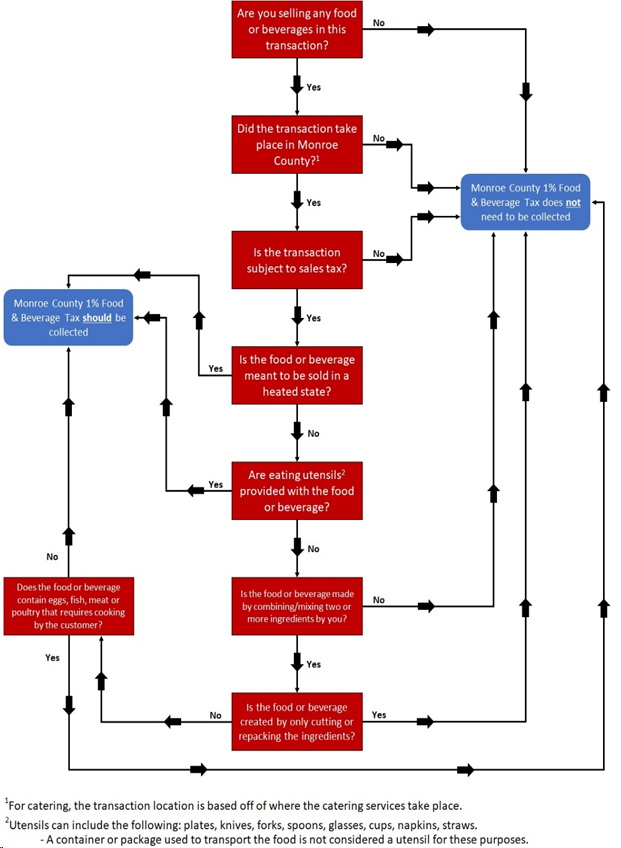

|

DATE OF LAST REVISION: |

08/02/2019 GL [reviewed samn 8/5/19]; |

|

RATIONALE: |

To provide Indiana University Departments with instructions on how to input sales tax into KFS documents, including CR, GEC. DI, DV, SB, YEDI and YEGE documents. |

|

PROCEDURES: |

1. As a state university, Indiana University is entitled to certain exemption from collecting sales tax for sales transactions that support the following missions of the university :

Teaching and instruction

2. Examples of transactions that are exempt from the sales and use tax are:

✓ Sales for resales

3. Sales transactions of tangible personal property that are not related to the missions of Indiana University or that are associated with a proprietary activity are subject to tax. 4. Three factors should be considered to determine the tax treatment of a sale transaction:

✓ Types of personal property (a taxable or non-taxable item)

5. The collection matrix (pg. 3 of this document) takes into account these factors to determine the tax treatment for typical sales transaction of Indiana University. 6. Each month, due by the 20 th , IU is required to report and to remit the sales tax (7%) collected in the prior month to the State of Indiana. Sales tax reporting is expected to be done timely. All tax collected should be reported in KFS by the 5 th of the month following the sale date. If the lag between payment date and sales date is more than 30 days, a clarification is needed in the note of the KFS document.

7. For transactions where sales tax was paid by various types of payment, if sales tax and 7% of the taxable sales are reported in different amounts in a KFS document, a clarification is needed in the note of the KFS document. 8. In order to record the sales tax information in a uniform manner, there is a “Tax information” line associated with several KFS documents. It is currently being used in the CR, GEC. DI, DV, SB, YEDI and YEGE documents. 9. Example on how to record Sales Tax on a KFS document. Ballantine Dinning Hall sells to students and the general public. Of the $302.89 total gross sales, $227.89 is to IU students. The $75.00 of taxable sales is to staff, faculty and the general public. Food sales to enrolled students are exempt from sales tax and would not be included in taxable sales. The cash receipt example is broken down below:

The “Tax Information” line will automatically appear below any tax accounting line when you use the 9015 object code in combination with one of these accounts:

The following information must be entered in the “Tax Information” line. Food and beverage tax needs to be reported separately in its own line:

The definitions for terms in column A, B, C, D and E are as follows:

A. Chart of Account for account number where sales revenue was recorded (not 96127XX)

10. Imputing Sales Tax – For sales where you need to report the sale with the sales tax included, you need to “impute” the sales tax, or calculate which portion of the amount is sales and which portion is tax. 11. Indiana Sales Tax Collection Matrix and Examples:

12. Flowchart to help determine whether or not to collect Monroe County Food and Beverage Tax:

13. Innkeepers Tax and Food & Beverage Tax are ADDITIONAL taxes, to be added to the Indiana sales tax.

Examples: 1) Ball State student comes to IU and stays at the IMU/Dorm during Spring Break. Collect innkeepers and sales tax, since not an IU student. If the student ate on campus the food would have sales tax and Monroe County Food and Beverage Tax charged. If the student brought a friend to dinner, that was an IU student, then the IU student’s food would be not be charged sales tax. 2) IU student and K-12 student comes to IU and stays at the IMU/Dorm during Spring Break to attend an educational program conducted by IU. No sales or innkeeper’s tax on the room. Nor would the students’ food purchases on campus have sales tax. 3) Over Christmas Break a 9th grade student attends an IU conducted resident, one week, swim camp on campus. No sales or innkeeper’s tax on the room. The food purchased on campus, during the camp week, would not be charged sales tax. 4) Over the summer an 11th grade student attends a coach conducted [non-IU], week long residential football camp on campus. Charge innkeepers and sales tax on the room. The food purchased on campus, during the camp week, would be subject to sales tax and Monroe County Food and Beverage Tax. 5) The History Department conducted a student awards gathering. This will be an internal billing. The room rental and the catered food would not be subject to sales tax. 6) The Law School has an all-day strategic planning meeting on campus [related to IU mission]. Breakfast and lunch is served. This is an internal billing. The room rental would not be charged sales tax. The catered food would have sales tax and Monroe County Food and Beverage Tax charged, unless business is conducted during the meal. 7) The Music school has a visiting professor stay at IMU/Dorm for 29 days. IMU/Housing will internally bill for the stay. Innkeepers’ tax and sales tax should not be collected on the stay. 8) Kelley School of Business hosts an executive banquet [assume unrelated to mission] on campus and catered by IU. The room and the catering should be charged sales tax regardless of means of billing. 9) RPS caters a dinner for the American Red Cross (not-for-profit organization). The room is exempt from sales tax; the food should have sales tax charged. If the meals are resold as a per plate fundraiser then there is an exemption from sale tax. [If IMU/Dorm stay, then that would be subject to innkeepers & sales tax]. 10) An alumni, private individual, or corporation hosts an event on campus. The room rental and the food would be subject to sales tax. |

|

DEFINITIONS: |

Tangible Personal Property – means personal property that: 1) can be seen, weighed, felt or touched: or 2) is any other manner perceptible to the senses. Proprietary Activities – is defined by the state of Indiana as an activity that generates revenues for state colleges or universities from the general public and that is both customarily associated with the conduct of a private business enterprise and that is outside the scope of activities of governmental and educational functions as defined for state college or universities. Related to IU Mission – means relating to all or one of the following activities: teaching, research or public services of the university. Indiana University Student – an individual enrolled or registered in courses that grant credit toward the attainment of an undergraduate degree or graduate degree at Indiana University. K-12 Student – Includes enrolled K-12 students attending IU operated educational conferences, camp, institutes, etc. Student Organizations – are informal student clubs whose memberships consist of students who share a common interest in the particular cause or activity for which the organization exists, promotes or furthers. Educational Related Program : Class or program provided by IU, not necessarily for college credit. Does not include events held at IU by third parties or as non-educational activities. Conference Attendees : Conference, camp or institute attendees other than IU and K-12 students. Exempt Entities : Non-profit or governmental entities that provide appropriate proof of exempt status. (A completed ST-105 from the entity or a US Department of State Exemption card for that individual). Non-Exempt Entities : Entities other than Tax Exempt Entities, including corporations, partnerships, LLC’s, etc. Private Individuals : Individuals (including IU employees) or their personal service corporations that sponsor conferences, camps, etc. Student Functions : An IU conducted function or activity where IU student participate. IU Department : Any department with an account in FIS NOTE: If the department bills a third party for the provided services, sales tax needs to be charged once and passed on to the third party. |

|

CROSS REFERENCES: |

Information Bulletin #68 Sales Tax & Nonprofit and State Colleges and Universities |