This page contains information about entering and managing direct deposit information, as well as the Rapid!Paycard program at Indiana University. Use the Table of Contents button to the right to jump to a topic.

IU policy FIN-ACC-040 dictates that employees, with few exceptions, must receive payroll payments via direct deposit or paycard. These payment methods ensure secure, timely transmission of employee wages.

Direct Deposit

Before You Start

First, locate your bank's routing number and your account number. This is the information you will use to establish payment via direct deposit. Your debit or credit card number is not your bank account number.

The image below provides an example of a routing and account number. The first group of numbers, labeled "1", represents the routing number. The second group of numbers, labeled "2" represents the account number.

The direct deposit system validates routing numbers but cannot validate account numbers. If you enter the wrong account number, your direct deposit could be rejected, or your payment could be deposited into someone else’s account. The university may not be able to recover your funds for you.

Set Up Initial Direct Deposit Account

- Open the Employee Center in One.IU.

- Click Payroll and Tax on the Employee Self Service page.

- Select the Direct Deposit tile.

- On the Direct Deposit Services page, read the statement and click on the Payroll button at the top.

- Your name will appear at the top of the Direct Deposit window. You will see field names, but no information will be in the lines below.

- Click the + (Add Account) button.

- Enter your bank routing number and account number, but do not use special characters such as * or -.

- Select the Account Type (Checking or Savings).

- Check the Payroll: Authorization (ACH Credit) statement box at the bottom-right of the window.

- Click the Save button on the upper-right side of the window.

You will see a confirmation message telling you that your set up was successful. You will also receive an email stating that your IU direct deposit account was created.

For new employees, a reimbursement account will be automatically created using your Balance of Net Pay account. You may change it to another account by following the change a bank account number instructions below.

Change a Bank Account Number

Do not click the Add Account button to change an existing account – it must be edited. You may only make changes to your direct deposit once every 24 hours.

Every employee must have a Balance of Net Pay account. You can change, but not delete, a Balance of Net Pay account. As the name implies, the Balance of Net Pay account is the account into which the balance of your net pay will go after deposits are made into all other accounts you specify. If you add more than one account, you will have to designate one of your accounts as the “Balance of Net Pay” account.

- Open the Employee Center in One.IU.

- Click Payroll and Tax on the Employee Self Service page.

- Select the Direct Deposit tile. You will see your current direct deposit account(s).

- Click the account you wish to change. Type over the existing routing number or account number with your new banking information. When entering your bank routing number and account number, do not use special characters such as * or -.

- Scroll down and check the box beside “I agree to the above terms and conditions."

- Click the Save button on the upper-right side of the edit window.

You will see a confirmation box telling you that your change was successful. You will also receive an email stating that your IU direct deposit account distribution was changed.

Add Additional Payroll Accounts

You can deposit your pay into multiple accounts and control how much to deposit into each account by either dollar amount or percentage.

One of your accounts will be your “Balance of Net Pay” account. As the name implies, the Balance of Net Pay account is the account into which the balance of your net pay will go after deposits are made into any other accounts you specify. If you add more than one account, you will have to designate one of your accounts as the “Balance of Net Pay” account.

- Open the Employee Center in One.IU.

- Click Payroll and Tax on the Employee Center Self Service page.

- Select the Direct Deposit tile.

- Your name will appear at the top of the Direct Deposit window.

- Click the + (Add Account) button.

- Enter your bank routing number and account number, but do not use special characters such as * or -.

- Select the Account Type (Checking or Savings) and the Deposit Type (Amount or Percent).

- Indicate the amount or percent of your pay you want deposited into your account.

- Check the Payroll: Authorization (ACH Credit) statement box at the bottom-right of the window.

- Click the Save button on the upper-right side of the edit window.

You will see a confirmation message telling you that your change was successful. You will also receive an email stating that your IU direct deposit account distribution was changed.

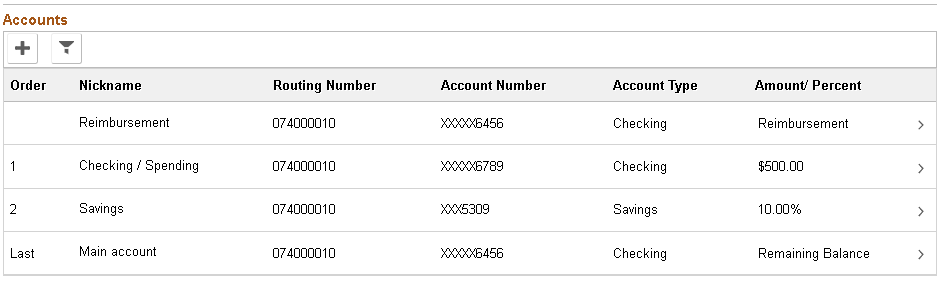

In the example below, $500.00 of this employee's paycheck will be deposited into the first checking account, which is listed as Deposit Order 1. Next, 10% of the check will be deposited into a savings account, listed as Deposit Order 2. The remaining net pay balance will be deposited into a second checking account. The Balance of Net Pay account will always be listed as Last.

Add a Reimbursement Account

Add a reimbursement account to receive your travel and out-of-pocket reimbursements via direct deposit.

- Open the Employee Center in One.IU.

- Click Payroll and Tax on the Employee Center Self Service page.

- Select the Direct Deposit tile.

- Your name will appear at the top of the Direct Deposit window.

- Click the + (Add Account) button.

- Enter your bank routing number and account number, but do not use special characters such as * or -.

- Select the Account Type (Checking or Savings).

- Select the Deposit Type (Reimbursement)

- Check the Payroll & Reimbursements: Authorization (ACH Credit) statement box at the bottom-right of the page.

- Click the Save button on the upper-right side of the edit window.

You will see a confirmation message telling you that your change was successful.

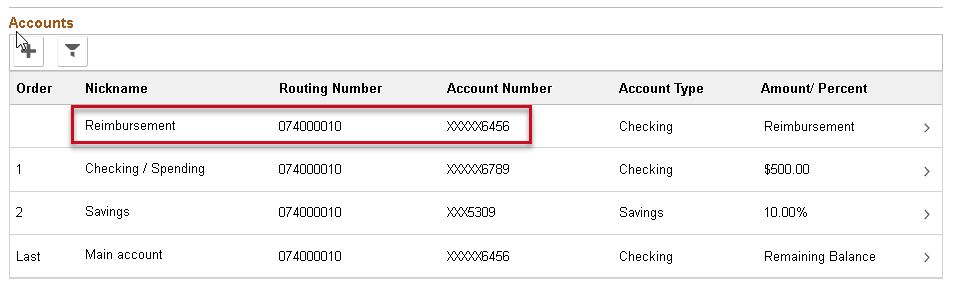

In the example below, all travel and out-of-pocket reimbursements will be disbursed to the account ending in 6456.

Delete a Direct Deposit Account

Every employee must have a Balance of Net Pay account. You can change, but not delete, a Balance of Net Pay account. Deleting a reimbursement account results in future travel and out-of-pocket reimbursements being issued via check and mailed to your campus address.

To delete a direct deposit account other than a Balance of Net Pay account, follow these instructions:

- Open the Employee Center in One.IU.

- Click Payroll and Tax on the Employee Center Self Service page.

- Select the Direct Deposit tile. You will see your current direct deposit accounts.

- Click on the account you want to delete.

- Click the "Remove" button on the bottom of the window.

- Click "Yes" that you are sure you want to remove the account.

The page will refresh and you will no longer see that account. You will also receive an email stating that your IU direct deposit account distribution was changed.

Fund a 529 Plan

It is easy to fund a 529 educational savings account through direct deposit. All you need is the 529 plan’s routing number and your 529 account number, which you must obtain from your 529 plan provider. To learn more about 529 plans and how to set them up, please visit IU's 529 College Savings Plan page.

- Open the Employee Center in One.IU.

- Click Payroll and Tax on the Employee Self Service page.

- Select the Direct Deposit tile.

- Your name will appear at the top of the Direct Deposit window.

- Click the + (Add Account) button.

- Enter the 529 plan routing number and 529 account number, but do not use special characters such as * or -.

- Select the Account Type (Savings) and the Deposit Type (Amount or Percent).

- Indicate the amount or percent of your pay you want deposited into your account.

- Check the Payroll: Authorization (ACH Credit) statement box at the bottom-right of the page.

- Click the Save button on the upper-right side of the edit window.

You will receive an email stating that your IU direct deposit account distribution was changed.

Discontinue Direct Deposit

Per Indiana University policy FIN-ACC-040, direct deposit for payroll is required for IU faculty and staff. If you need to discontinue direct deposit for your paychecks, please contact UCO Customer Service via the online support form, by phone, or in person to discuss your situation.

Rapid!Paycard

Typically, IU issues paycards to employees who have not signed up for direct deposit prior to their third paycheck. Paycards will be held at the local campus payroll office to be picked up by either the employee or the employee’s department Fiscal Officer, Fiscal Approver, Account Manager, or Account Supervisor. A photo ID is required for pickup. Paycards can also be mailed directly to the employee, only after the employee has verified their address in the HRMS payroll system.

Paycard funds are available on payday by 10 a.m. EST/EDT.

Fees

The first transaction after every pay load is free when using one of the following withdrawal methods:

- PIN point of sale purchase with cash back (where available).

- United States Postal Money Order.

- Allpoint surcharge free ATM withdrawal.

- ChekToday - write yourself a Rapid!Paycard check and cash it free at any Wal-Mart in the U.S.

- Request a check - Rapid!Paycard will write a check drawn on your account to pay to a vendor that does not accept electronic payments (for example, a landlord).

- Over the counter bank withdrawal.

Subsequent withdrawals incur fees charged to your paycard account. The table below provides a breakdown of these additional fees.

| Activity | Fee | Limit (if any) |

|---|---|---|

| Credit card purchase— not using PIN | Free | Daily limit $5050 |

| PIN point of sale purchase (including cash back) | $ .50 | Daily limit $5050 |

| Allpoint ATM withdrawal | $1.75 | Daily limit $1025, although some vendors will have lower limits set per transaction. |

| Request a check | $2.99 | |

| United States Postal Money Order | $0.50 | Daily limit $1000 |

| Electronic transfer to another bank account | $1.50 | |

| ChekToday | $3.00 | |

| Over the counter bank withdrawal | $4.00 | Daily limit $5050 |

| Printed and mailed statement | $1.50 | |

| Card replacement | $10.00 | |

| Bill Pay | $1.50 | |

| ATM balance inquiry or ATM decline | $0.75 | |

| Point of sale declined | $0.50 | |

| Inactivity fee (after 6 months) | $4.95 |

Account Management & Resources

Visit the Rapid!Paycard home page to manage your account and learn more about cardholder benefits.

Additional paycard resources: